Personal Online Account Dashboard

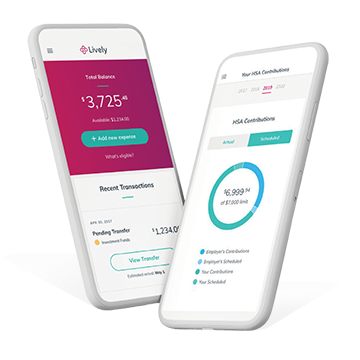

Your personalized online HSA dashboard allows you to conveniently set up, fund, and manage your HSA from your computer browser or on the go with the “Lively HSA” mobile app.

Easy Contributions & Transfers

Set up post-tax contributions from your bank account, or your employer may be able to make pre-tax contributions into your HSA. Lively doesn't charge for rollovers or transfers from another provider.

Investment Options

With the triple tax savings, you can take advantage of pre-tax or tax-deductible contributions and tax-free interest and investment earnings, distributions, and investment options.¹

Free Online Resources

Online tools provide guidance on how much to contribute each year and how your savings will grow over time. Lively also provides free dynamic and timely educational content.

HSA Debit Card, the healthy way to pay!

Easily and conveniently pay your doctor’s office, pharmacy, or any other qualified medical expense where Visa is accepted.

Download the HSA Mobile App!

The Lively mobile app allows you to manage accounts, reimbursements, healthcare expenses, spending, contributions, and even monitor your investments.

A Centier Bank HSA, powered by Lively, makes it easy to save for healthcare expenses and access a wide variety of investment options. Lively's resource center gives you helpful HSA articles, guides, tools, and more.

Frequently Asked Questions About HSAs

Lively provides two ways to access investment capabilities through Schwab Health Savings Brokerage Account by Charles Schwab. Account holders can choose to invest anything above $3,000 for no access fee from Lively or invest with no restrictions after a $24 annual access fee from Lively. Please note that other investment fees from Charles Schwab may apply. Learn more2.

Lively charges a 0.50% annual management fee for access to investment capabilities through the HSA Guided Portfolio by Devenir, including automated features such as rebalancing. The fee is based off of invested assets and debited quarterly.

Be sure to consult with a financial planning and/or tax professional as needed to understand your options.

No, unlike with a Flexible Spending Account (FSA), HSA funds never expire. The HSA is owned by you, not your employer, so even when your job situation changes, you don’t have to worry about losing the funds in your HSA.

You can use your HSA for a wide range of qualified expenses, such as doctor's visits, prescription drugs, imaging, lab work, medical equipment, contact lenses, dental work, physical therapy… the list goes on. Find out what is eligible for reimbursement.

The IRS sets annual contribution limits for HSAs. In 2025, individuals may contribute up to $4,300, and families may contribute up to $8,550. If you are 55 or older, you may add another $1,000 on top of that. 1

An HSA can be an interest-bearing health account used for qualifying medical expenses, with the IRS's maximum contribution limits set annually. The HSA can only be used with a qualifying high-deductible health plan (HDHP), traditionally known for lower premiums and high-deductibles. A qualifying HDHP has a minimum deductible and out-of-pocket maximum that is set annually by the IRS.

You’re eligible if you’re covered by a qualifying High-Deductible Health Plan (HDHP). The HDHP is your only health insurance coverage. Meaning, you don’t have supplemental coverage from a spouse or other family member (dental and vision is fine). You don’t have or use a General Purpose FSA (Flexible Spending Account). But, you are allowed to have a Limited Purpose FSA for dental, vision, or a Dependent Care FSA. Note: You can have an existing HSA and open an FSA. Your HSA funds will remain, but you cannot continue contributing to the health savings account. No one else can claim you as a dependent on their tax return. You’re between the ages of 18 and 65 and not enrolled in or eligible for Medicare (Part A and Part B) or Medicaid. Read more on the health plan and personal requirements for HSA-eligibility .

Disclosures

FDIC insured through Centier Bank, for so long as funds remain uninvested and on deposit with Centier Bank. Centier Bank Health Savings Accounts, powered by Lively are provided by Lively Inc. and are subject to their approval. Lively Inc. is not affiliated with Centier Bank.

¹Contributions to and earnings on HSAs are not subject to federal taxes but may be subject to state taxes depending on where you reside. Centier Bank does not provide tax or legal advice. Seek the advice of your own tax and legal professionals to ensure your compliance with applicable HSA and other laws. Investment options are provided by Charles Schwab and Devenir; fees may apply.

2Investments are: NOT FDIC INSURED – NOT BANK GUARANTEED – NOT A DEPOSIT – MAY LOSE VALUE.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Google Play is a trademark of Google Inc. Lively HSA Card is issued by Choice Financial Group pursuant to a license from Visa U.S.A. Inc.