Small Business Budget Example

Last Updated: May 16, 2024

Small Business Budget: Build a Solid Financial Plan

Managing finances is crucial for the success of any small business. A clear small business budget provides a roadmap to allocate resources effectively, manage cash flow, and achieve financial goals.

In this guide, we'll explain the essentials of building a small business budget and provide a practical example and template to help you kickstart your financial planning.

What Should be Included in a Small Business Budget?

When creating a small business budget, you must include certain elements. This way, you can be sure your financial planning is thorough.

Consider each of the following:

- Revenue projections.

- Operating expenses.

- One-time expenses.

- Taxes.

- Contingency fund.

Estimate your expected income from sales, services, and other sources. Account for all regular expenses. This should include rent, utilities, salaries, marketing, and office supplies. Factor in occasional or unexpected costs, such as equipment purchases or repairs.

Set aside funds for federal, state, and local taxes, including income tax, sales tax, and payroll taxes. Allocate a portion of your budget for emergencies or unforeseen circumstances.

You might also like: Typical Marketing Budget for Small Business to Unlock Success

How Do I Create Simple Business Budgets?

A simple budget offers clarity, control, and insight into your business finances. It helps you track income, expenses, and cash flow, enabling better decision-making and helping you reach your goals. With a straightforward budget, you can identify opportunities and drive business growth.

Follow these steps to create a simple budget for your business.

You might also like: Small Business vs. Micro Business: Differences Explained

1. Assess Your Finances

2. Set Financial Goals

3. Estimate Income

4. Identify Expenses

5. Create a Budget Spreadsheet

6. Monitor and Adjust

Example Budget Templates

Using a sample business budget template can simplify creating a budget in several ways. First, it gives you a clear plan to follow so you don't miss anything important. You simply fill in the blanks with your numbers, making the whole process more organized and easier to manage.

Plus, you can use the same template again in the future or change it to fit different needs. It saves time because you don't have to start from scratch. The template already has categories set up, so you only need to add your numbers in the right places. This helps reduce mistakes. Overall, using a sample business budget template makes budgeting easier by giving you a roadmap to follow and saving you time and effort.

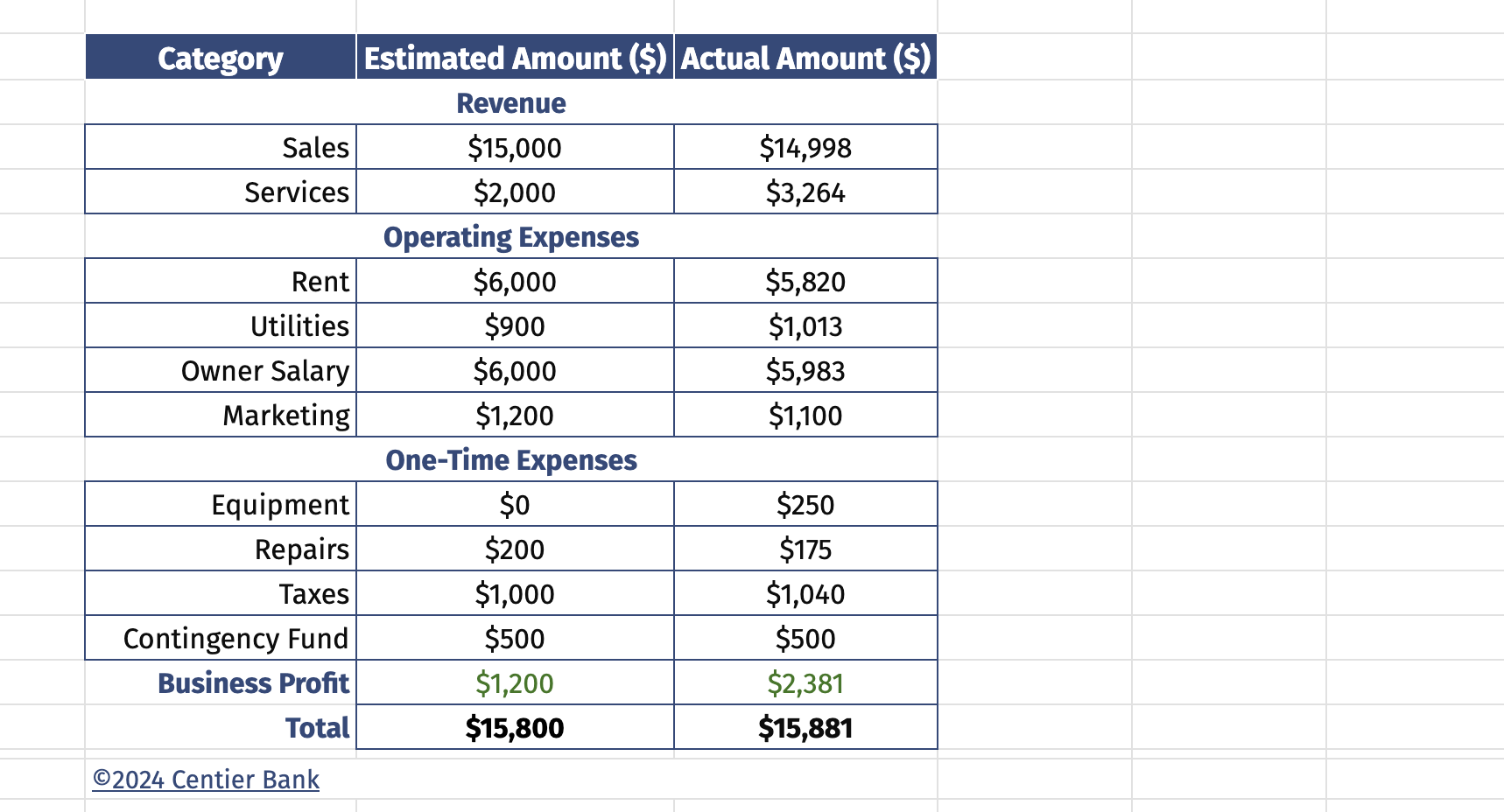

Here’s a sample small business budget template to help you get started:

The estimated amounts are based on a hypothetical quarterly budget of $15,000.

You might also like: Money Management: How To Create a Budget That Works For You

Rock Your Small Business Budget When You Bank with Centier

Creating a budget for your small business lays a solid foundation for a bright future. When you plan and manage your money wisely, you set yourself up for success. Sure, there might be ups and downs along the way, but with a clear budget in place, you can tackle any financial challenges that come your way.

Plus, you'll be ready to grab hold of exciting opportunities when they arise. So, why wait? Start building your budget today and pave the way for a thriving business tomorrow with Centier by your side.

Find out more about Centier’s small business banking.

Frequently Asked Questions

Examples of What should be included in a small business budget?

A small business budget should encompass revenue projections, operating expenses, one-time expenses, taxes, and a contingency fund to cover unexpected costs.

How do I create a simple business budget?

To create a simple business budget, assess your finances, set financial goals, estimate income, identify expenses, create a budget spreadsheet, and regularly monitor and adjust your budget.